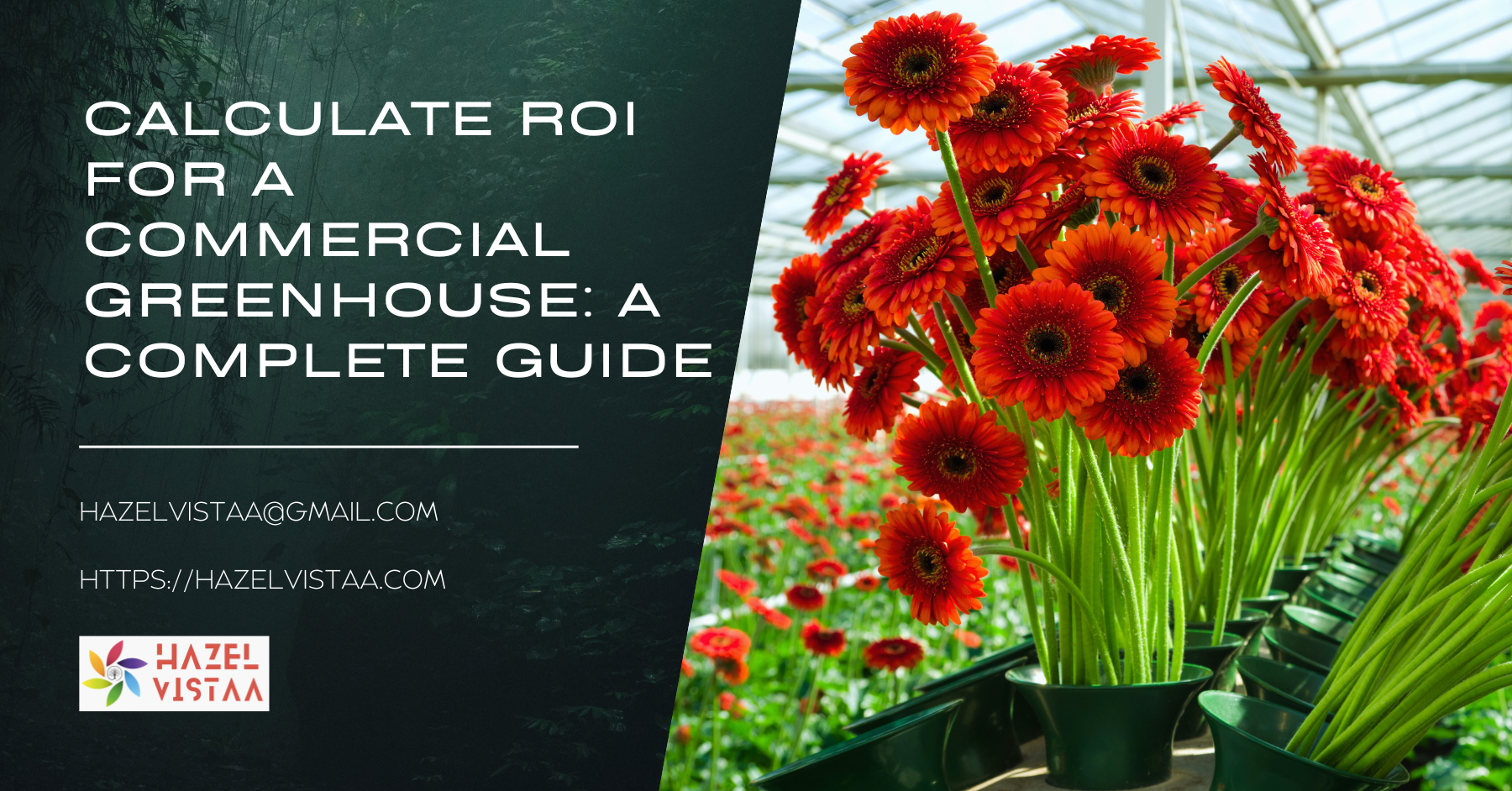

Learn how to accurately calculate ROI for a commercial greenhouse in 2024. Our comprehensive guide covers revenue, costs, and crucial factors to consider for maximizing profitability.

How to Calculate ROI for a Commercial Greenhouse

To calculate ROI for a commercial greenhouse:

- Use the formula: ROI = (Net Profit / Total Investment) x 100

- Determine total revenue from crop sales

- Subtract all operating costs (labor, utilities, supplies)

- Calculate net profit: Revenue – Operating Costs

- Divide net profit by total greenhouse investment (construction + equipment)

- Multiply by 100 to get ROI percentage

Example:

- Revenue: $100,000

- Operating Costs: $70,000

- Net Profit: $30,000

- Total Investment: $200,000

- ROI = (30,000 / 200,000) x 100 = 15%

This greenhouse has a 15% return on investment.

Introduction

Hey there, fellow greenhouse enthusiasts! I’ve been in the commercial greenhouse game for over a decade now, and let me tell you, calculating ROI can be a real head-scratcher. But don’t worry, I’ve made every mistake in the book so you don’t have to!

Why ROI Matters in Greenhouse Operations

ROI, or Return on Investment, is the lifeblood of any business, and greenhouses are no exception. It’s not just about growing pretty plants – it’s about growing your bank account too! Here’s a quick breakdown of why ROI is crucial:

| Aspect | Importance |

| Financial Health | Measures profitability |

| Decision Making | Guides investment choices |

| Efficiency | Identifies areas for improvement |

| Sustainability | Ensures long-term viability |

Common ROI Misconceptions in Greenhouse Farming

Before we dive in, let’s bust some myths:

- “Higher yield always means higher ROI” – Not necessarily! Sometimes less is more.

- “Expensive tech guarantees better returns” – Ooh boy, if I had a dollar for every fancy gadget that didn’t pay off…

- “ROI is only about money in vs. money out” – There’s so much more to it, trust me!

What We’ll Cover Today

- The nitty-gritty of ROI calculation

- Factors that can make or break your greenhouse profits

- Real-world examples (including some of my epic fails!)

- Tips to boost your ROI without breaking the bank

Today, I’m gonna walk you through the ins and outs of figuring out if your greenhouse is actually making you money or if it’s just a really expensive hobby. Trust me, I’ve been there – staring at a bunch of numbers, wondering if I should’ve just stuck to growing tomatoes in my backyard.

But with a little know-how and some simple math (don’t worry, I’ll keep it easy), you’ll be crunching those ROI numbers like a pro. So, grab a cup of coffee, and let’s dive into the world of greenhouse economics!

Key Takeaways

- ROI is crucial for greenhouse success

- Common misconceptions can lead to poor decisions

- We’ll cover calculation methods and real-world examples

- Improving ROI is an ongoing process

Remember, folks, calculating ROI isn’t just about numbers – it’s about growing a sustainable, profitable greenhouse operation. So, let’s roll up our sleeves and get to it!

1. Understanding ROI in Commercial Greenhouse Operations

What is ROI and Why Should Greenhouse Owners Care?

ROI, or Return on Investment, is basically how much money you’re making compared to how much you’ve put in. It’s like planting a seed and seeing how big the harvest is. In greenhouse terms:

ROI = (Net Profit / Total Investment) x 100

Why it matters:

- Shows if your greenhouse is actually profitable

- Helps you decide where to invest your hard-earned cash

- Compares different crops or technologies

- Attracts investors or secures loans (trust me, banks love good ROI numbers!)

Factors Specific to Greenhouse Operations That Impact ROI

Now, greenhouses aren’t your average business. We’ve got some unique factors that can make or break our ROI:

| Factor | Impact on ROI | Example |

| Climate Control | High | A 10% reduction in energy costs can boost ROI by 2-5% |

| Crop Selection | Very High | Switching from tomatoes to high-value herbs can double ROI |

| Growing System | Medium | Hydroponic systems can increase yield by 30-50% |

| Labor Management | High | Automation can reduce labor costs by up to 40% |

| Market Demand | Very High | Aligning with trends can increase revenue by 20-30% |

Common Misconceptions About Greenhouse Profitability

Oh boy, have I heard some doozies over the years. Let’s bust some myths:

- “Bigger is always better”

- Reality: Sometimes smaller, specialized operations have higher ROI

- “Technology always improves ROI”

- Reality: Only if it solves a specific problem in your operation

- “High yields guarantee high profits”

- Reality: Overproduction can lead to waste and lower prices

- “ROI is all about cutting costs”

- Reality: Sometimes spending more on quality inputs boosts ROI

How ROI Differs in Greenhouse vs. Traditional Farming

Greenhouse farming is a whole different ballgame compared to field farming. Here’s a quick comparison:

| Aspect | Greenhouse | Traditional Farming |

| Initial Investment | Higher | Lower |

| Yield per Acre | Much Higher | Lower |

| Growing Season | Year-round | Seasonal |

| Climate Control | High | Limited |

| Labor Costs | Generally Higher | Can be Lower |

| Market Flexibility | Higher | Lower |

The Role of ROI in Long-term Greenhouse Success

Think of ROI as your greenhouse’s report card. It’s not just about passing – it’s about excelling and growing over time. Here’s how ROI plays into long-term success:

- Guides expansion decisions: Should you add another greenhouse or optimize existing ones?

- Informs crop selection: Which crops are your money-makers, and which are just taking up space?

- Justifies technology investments: Is that fancy new irrigation system worth it?

- Attracts partners and investors: Strong ROI can open doors to new opportunities

- Ensures sustainability: A healthy ROI means your greenhouse can weather tough times

Calculating Baseline ROI for Your Greenhouse

Before we dive into improving ROI, let’s figure out where you stand. Here’s a simple way to calculate your baseline:

- Add up all revenue for the past year

- Subtract all expenses (don’t forget things like depreciation!)

- Divide by your total investment

- Multiply by 100 for percentage

Example:

Annual Revenue: $500,000

Annual Expenses: $400,000

Total Investment: $1,000,000

ROI = ($500,000 – $400,000) / $1,000,000 x 100 = 10%

A 10% ROI is pretty average in the greenhouse world. If you’re below this, don’t panic! We’re about to dive into ways to boost that number.

Remember, folks, understanding ROI isn’t just about numbers – it’s about seeing the big picture of your greenhouse’s health and potential. It’s like having a stethoscope for your business!

2. Step-by-Step Guide to Calculate Greenhouse ROI

Determining Total Investment Costs

First things first, we need to figure out how much moolah you’ve sunk into your greenhouse operation. This isn’t just about the cash you spent on that shiny new greenhouse structure!

Here’s a breakdown of what to include:

- Initial setup costs:

- Greenhouse structure

- Land purchase or lease

- Site preparation

- Permits and licenses

- Equipment and systems:

- Irrigation system

- Climate control (heating, cooling, ventilation)

- Lighting

- Benches or growing systems

- Startup expenses:

- Initial plant stock or seeds

- First round of fertilizers and pesticides

- Marketing and branding costs

Let’s put this into a handy table:

| Investment Category | Examples | Your Costs ($) |

| Greenhouse Structure | Frame, covering, installation | |

| Land | Purchase price or annual lease | |

| Site Preparation | Grading, utilities connection | |

| Climate Control | HVAC, fans, shade cloth | |

| Irrigation | Pipes, pumps, controllers | |

| Growing Systems | Hydroponic setup, benches | |

| Initial Stock | Seeds, seedlings, mother plants | |

| Other | Permits, marketing, misc. | |

| TOTAL INVESTMENT |

Pro tip: Don’t forget to include any loans or interest in your total investment calculation!

Calculating Annual Revenue from Crop Sales

Now for the fun part – counting your hard-earned cash! This step is all about tallying up your greenhouse’s annual revenue.

Here’s how to break it down:

- List all crops you’ve grown

- Calculate sales for each crop

- Add any additional income (tours, workshops, etc.)

Let’s see an example:

| Crop | Units Sold | Price per Unit ($) | Total Revenue ($) |

| Tomatoes | 10,000 lbs | 2.50 | 25,000 |

| Cucumbers | 8,000 lbs | 1.75 | 14,000 |

| Herbs | 5,000 bunches | 2.00 | 10,000 |

| Specialty Peppers | 3,000 lbs | 4.00 | 12,000 |

| TOTAL ANNUAL REVENUE | 61,000 |

Remember: Be honest with these numbers. We’re not trying to impress anyone – we’re trying to improve our business!

Identifying and Summing Up Operating Expenses

Now comes the part that might make you wince a little. We need to tally up all those pesky expenses that eat into our revenue.

Here’s a list of common greenhouse operating expenses:

- Labor costs (including your own time!)

- Utilities (electricity, water, gas)

- Growing media and containers

- Seeds and plants

- Fertilizers and pesticides

- Maintenance and repairs

- Marketing and sales expenses

- Insurance and taxes

- Depreciation of equipment and structures

Let’s put it all in a table:

| Expense Category | Annual Cost ($) |

| Labor | |

| Utilities | |

| Growing Supplies | |

| Maintenance | |

| Marketing | |

| Insurance & Taxes | |

| Depreciation | |

| Other | |

| TOTAL EXPENSES |

Pro tip: Keep detailed records throughout the year. Trust me, your future self will thank you when it’s time to crunch these numbers!

Applying the ROI Formula with Real-World Examples

Okay, moment of truth! Let’s plug our numbers into the ROI formula:

ROI = (Net Profit / Total Investment) x 100

Where:

- Net Profit = Total Revenue – Total Expenses

- Total Investment = Your initial investment (from step 1)

Let’s work through an example:

Total Revenue: $61,000

Total Expenses: $45,000

Net Profit: $61,000 – $45,000 = $16,000

Total Investment: $200,000

ROI = ($16,000 / $200,000) x 100 = 8%

So in this example, the greenhouse has an 8% ROI. But what does that mean? Let’s break it down:

| ROI Percentage | What It Means |

| <0% | You’re losing money. Time to make some changes! |

| 0-5% | Breaking even or slight profit. Room for improvement. |

| 5-10% | You’re doing okay, but could be better. |

| 10-15% | Now we’re talking! Solid performance. |

| >15% | Excellent! You’re killing it! |

Interpreting Your ROI Results

Now that you’ve got your ROI number, don’t just pat yourself on the back (or bang your head against the wall). Use this information to guide your decisions:

- If your ROI is low:

- Identify your biggest expenses. Can they be reduced?

- Look at your crop mix. Are there more profitable options?

- Consider ways to increase revenue (direct sales, value-added products)

- If your ROI is high:

- What’s working well? Can you replicate this success?

- Is it time to expand or invest in new technology?

- Don’t get complacent – markets can change quickly!

Remember, ROI is just one piece of the puzzle. It’s a snapshot of your greenhouse’s financial health, but it doesn’t tell the whole story. Use it as a tool, not a rulebook!

Final thoughts: Calculating ROI might seem like a chore, but trust me, it’s the secret sauce to running a successful greenhouse. It’s like giving your plants the perfect nutrient mix – it helps everything grow better!

3. Key Factors Influencing Greenhouse ROI

Crop Selection and Market Demand

Listen up, because this is crucial: choosing the right crops can make or break your greenhouse business. It’s not just about what you like to grow – it’s about what sells!

Crop Profitability Comparison

Here’s a quick comparison of some popular greenhouse crops:

| Crop | Avg. Yield (lbs/sq ft) | Avg. Price ($/lb) | Potential Revenue ($/sq ft) | Difficulty Level |

| Tomatoes | 7-10 | 2.00-3.50 | 14-35 | Medium |

| Lettuce | 0.5-1 | 3.00-5.00 | 1.5-5 | Easy |

| Cucumbers | 6-8 | 1.50-2.50 | 9-20 | Medium |

| Bell Peppers | 2-3 | 2.50-4.00 | 5-12 | Medium-Hard |

| Herbs (Basil) | 0.5-1 | 15.00-25.00 | 7.5-25 | Easy |

| Strawberries | 1-2 | 4.00-8.00 | 4-16 | Medium-Hard |

Pro tip: Don’t just chase high prices. Consider your local market, growing conditions, and your expertise!

Energy Efficiency and Utility Costs

Let me tell you, utility bills can eat up your profits faster than aphids on a tender shoot. Energy efficiency is key to boosting your ROI.

Energy-Saving Strategies Impact

| Strategy | Potential Energy Savings | Estimated ROI Improvement |

| High-efficiency HVAC | 20-30% | 2-4% |

| LED Lighting | 40-50% on lighting costs | 1-3% |

| Thermal Curtains | 20-30% on heating | 1-2% |

| CO2 Enrichment | 20-30% yield increase | 2-5% |

| Smart Climate Controls | 10-20% overall | 1-3% |

Remember, these are ballpark figures. Your mileage may vary, but the point is: small changes can add up to big savings!

Labor Management and Automation

I’ve seen many greenhouse owners (myself included) work themselves to the bone. But here’s the thing: your time is valuable, and efficient labor management is crucial for ROI.

Labor vs. Automation Comparison

| Task | Manual Labor Cost* | Automation Cost** | Potential Savings |

| Irrigation | $5,000/year | $10,000 upfront | $2,500/year after 4 years |

| Climate Control | $8,000/year | $15,000 upfront | $5,000/year after 3 years |

| Harvesting | $20,000/year | $50,000 upfront | $10,000/year after 5 years |

Estimated annual cost for a small-medium greenhouse *Upfront cost of automated systems

Key takeaway: Automation can be expensive upfront but often pays off in the long run. It’s not just about saving money – it’s about freeing up your time to focus on growing your business!

Pest Control and Crop Loss Prevention

Nothing kills ROI faster than losing a crop to pests or disease. Trust me, I’ve had sleepless nights over this one. Prevention is always cheaper than cure.

Pest Management ROI Impact

| Method | Cost* | Potential Crop Loss Prevention | ROI Impact |

| Regular Monitoring | $2,000/year | 10-15% | +3-5% |

| Integrated Pest Management (IPM) | $5,000/year | 20-30% | +5-8% |

| Beneficial Insects | $3,000/year | 15-25% | +4-7% |

| High-Tech Solutions (e.g., UV-C) | $10,000 upfront | 30-40% | +7-10% after 2 years |

*Estimated costs for a small-medium greenhouse

Remember: These methods work best when combined. Don’t put all your eggs in one basket (or all your pests in one trap)!

Climate Control and Growing Environment

Here’s something I learned the hard way: the perfect growing environment is your ticket to higher yields and better quality. And better quality means better prices!

Climate Factors and Their Impact

| Factor | Optimal Range | Impact on Yield | Potential ROI Boost |

| Temperature | Crop-specific | ±20-30% | ±5-8% |

| Humidity | 50-70% | ±10-15% | ±2-4% |

| CO2 Levels | 1000-1500 ppm | +20-30% | +5-8% |

| Light Intensity | Crop-specific | ±15-25% | ±3-6% |

Pro tip: Invest in good monitoring equipment. You can’t manage what you don’t measure!

Marketing and Sales Strategies

You can grow the best produce in the world, but it won’t matter if you can’t sell it. Smart marketing can significantly boost your ROI.

Sales Channel Comparison

| Channel | Profit Margin | Time Investment | Market Stability |

| Wholesale | 20-30% | Low | High |

| Farmers Markets | 40-50% | High | Medium |

| CSA Programs | 50-60% | Medium | High |

| Direct to Restaurants | 30-40% | Medium | Medium |

| Online Sales | 40-50% | Medium-High | Low-Medium |

Key point: Diversifying your sales channels can help stabilize income and potentially increase overall ROI.

Continuous Improvement and Innovation

Last but not least, never stop learning and improving. The greenhouse industry is always evolving, and staying ahead of the curve can give you a serious ROI boost.

Innovation ROI Impact

| Innovation Area | Initial Investment | Potential ROI Improvement |

| New Crop Varieties | $1,000-$5,000 | +2-5% |

| Advanced Growing Techniques | $5,000-$20,000 | +5-10% |

| Sustainable Practices | $2,000-$10,000 | +3-7% |

| Data-Driven Decision Making | $1,000-$5,000 | +4-8% |

Remember, these are just estimates. The real ROI comes from applying these innovations effectively in your unique situation.

4. Maximizing ROI Through Efficient Greenhouse Design

Optimal Greenhouse Structures for Different Climates

First things first: your greenhouse structure needs to work with Mother Nature, not against her. Here’s a breakdown of greenhouse types and how they fare in different climates:

| Greenhouse Type | Best Climate | Energy Efficiency | Initial Cost | Lifespan | ROI Impact |

| Gothic Arch | Temperate | High | Medium | 15-20 years | +5-8% |

| Quonset | Mild | Medium | Low | 10-15 years | +3-6% |

| A-Frame | Cold | High | High | 20-25 years | +7-10% |

| Lean-To | Urban/Limited Space | Medium | Low | 10-15 years | +4-7% |

| Venlo | All | Very High | Very High | 30+ years | +10-15% |

Pro tip: Don’t just think about today’s weather. Consider climate trends for the next 10-20 years. That Quonset hut might seem cheap now, but will it hold up to increasing storm intensity?

Implementing Energy-Saving Technologies

Listen up, because this is where the magic happens. Energy-efficient tech can turn your greenhouse from a money pit into a profit machine. Here’s the lowdown:

Energy-Saving Tech Comparison

| Technology | Energy Savings | Initial Cost | Payback Period | 10-Year ROI Impact |

| LED Grow Lights | 40-50% | High | 2-3 years | +15-20% |

| Thermal Screens | 20-30% | Medium | 3-4 years | +10-15% |

| Heat Pumps | 30-50% | High | 4-5 years | +12-18% |

| Solar Panels | 60-80% | Very High | 5-7 years | +20-25% |

| Smart Climate Controls | 15-25% | Medium | 2-3 years | +8-12% |

Remember: These numbers can vary based on your specific situation. But the principle holds true: invest in efficiency, and your future self will thank you!

Space Utilization and Vertical Farming Techniques

Okay, time for some real talk: every square foot of your greenhouse should be working hard to earn its keep. Here’s how to make the most of your space:

Space Optimization Strategies

| Strategy | Yield Increase | Implementation Cost | Space Efficiency | ROI Boost |

| Vertical Growing Systems | 200-300% | High | Excellent | +15-25% |

| Intercropping | 30-50% | Low | Good | +5-10% |

| Movable Benches | 20-30% | Medium | Very Good | +8-12% |

| NFT Systems | 50-100% | Medium-High | Excellent | +10-20% |

| Rotating Crops | 15-25% | Low | Good | +3-8% |

Pro tip: Don’t go overboard trying to cram plants into every nook and cranny. Good airflow and access for maintenance are crucial!

Material Selection for Long-Term Efficiency

I’ve learned the hard way that cutting corners on materials is like shooting yourself in the foot. Here’s a comparison of greenhouse covering materials:

| Material | Light Transmission | Insulation | Lifespan | Initial Cost | Long-Term ROI Impact |

| Single-Layer Polyethylene | 85-87% | Poor | 3-5 years | Low | Baseline |

| Double-Layer Polyethylene | 80-82% | Good | 4-6 years | Low-Medium | +3-5% |

| Polycarbonate | 80-85% | Excellent | 15-20 years | High | +8-12% |

| Glass | 90-92% | Good | 30+ years | Very High | +10-15% |

| ETFE Film | 90-95% | Good | 25-30 years | High | +12-18% |

Key takeaway: Sometimes, spending more upfront can seriously boost your long-term ROI. Think of it as an investment, not an expense!

Water Management and Irrigation Efficiency

Water is life, but it’s also money. Efficient water management is crucial for both your plants and your profits. Check out these irrigation methods:

| Irrigation Method | Water Efficiency | Initial Cost | Labor Requirement | Crop Suitability | ROI Impact |

| Drip Irrigation | 90-95% | Medium | Low | Most crops | +8-12% |

| Ebb and Flow | 80-85% | Medium-High | Low | Potted plants | +6-10% |

| Misting Systems | 70-75% | Low-Medium | Medium | Propagation/Leafy greens | +4-8% |

| NFT Systems | 95-98% | High | Low | Leafy greens/Herbs | +10-15% |

| Capillary Mats | 85-90% | Low | Low | Bedding plants | +5-9% |

Pro tip: Combine efficient irrigation with water recirculation systems for maximum savings and environmental brownie points!

Future-Proofing Your Greenhouse Design

Last but not least, let’s talk about designing for the future. The greenhouse industry is evolving faster than a tomato plant in the height of summer!

Future-Proofing Strategies

| Strategy | Initial Investment | Adaptability | Tech Integration | Long-Term ROI Potential |

| Modular Design | Medium | Excellent | Good | +10-15% |

| Smart-Tech Ready Infrastructure | Medium-High | Very Good | Excellent | +12-18% |

| Renewable Energy Integration | High | Good | Very Good | +15-20% |

| Scalable Automation Systems | High | Very Good | Excellent | +18-25% |

| Multi-Purpose Growing Areas | Medium | Excellent | Good | +8-12% |

Remember: The goal is to create a greenhouse that can adapt to new technologies and changing market demands without requiring a complete overhaul.

5. Financial Considerations for Greenhouse ROI Calculation

Depreciation of Greenhouse Assets

First up, let’s talk about depreciation. It’s not the most exciting topic, but understanding depreciation is crucial for accurate ROI calculations and tax planning.

Depreciation Methods Comparison

| Method | Description | Best For | Impact on ROI Calculation |

| Straight-Line | Equal deduction each year | Simplicity | Steady, predictable impact |

| Declining Balance | Larger deductions early on | Quick write-offs | Front-loaded benefit |

| Sum-of-Years-Digits | Accelerated method | Balancing speed and accuracy | Moderate front-loading |

| Units of Production | Based on usage | Variable production | Reflects actual use |

Pro tip: Choose a method that aligns with your business strategy and cash flow needs. Remember, depreciation affects your taxable income, which in turn impacts your ROI!

Here’s a quick example of straight-line depreciation for a $100,000 greenhouse with a 20-year lifespan:

Annual Depreciation = (Cost – Salvage Value) / Useful Life

Annual Depreciation = ($100,000 – $10,000) / 20 years = $4,500/year

Financing Options and Interest Costs

Now, unless you’re sitting on a pile of cash, you’ll likely need financing for your greenhouse venture. Let’s break down some options:

| Financing Type | Interest Rate Range | Term Length | Best For | Impact on ROI |

| Bank Loan | 4-8% | 5-20 years | Established businesses | Moderate negative |

| SBA Loan | 5-9% | Up to 25 years | Small businesses | Moderate negative |

| Equipment Financing | 6-12% | 1-5 years | Specific equipment | Short-term negative |

| Agricultural Grants | 0% | N/A | Specific projects | Positive |

| Investor Funding | Varies | Varies | High-growth potential | Varies |

Remember: Lower interest rates are great, but also consider terms, flexibility, and how the debt affects your overall financial picture.

Tax Implications and Incentives for Agricultural Businesses

Taxes might make you want to pull your hair out, but understanding agricultural tax benefits can significantly boost your ROI. Here’s a rundown of some key considerations:

| Tax Consideration | Description | Potential ROI Impact |

| Section 179 Deduction | Allows full expensing of certain equipment in year of purchase | +2-5% in purchase year |

| Bonus Depreciation | Additional depreciation on new equipment | +1-3% in early years |

| Agricultural Tax Credits | Credits for things like organic certification or energy efficiency | +1-4% depending on credits |

| Farm Income Averaging | Spread out income over 3 years to lower tax bracket | +1-2% in high-income years |

| Conservation Easements | Tax deductions for preserving land | Varies widely |

Pro tip: Always consult with a tax professional familiar with agricultural businesses. The rules can be complex and change frequently!

Cash Flow Management and Seasonal Variations

In the greenhouse biz, cash flow is king. Let’s look at how to manage the ebb and flow of greenhouse finances:

Monthly Cash Flow Example for a Small Greenhouse

| Month | Revenue | Expenses | Net Cash Flow | Cumulative Cash |

| January | $5,000 | $8,000 | -$3,000 | -$3,000 |

| February | $6,000 | $7,500 | -$1,500 | -$4,500 |

| March | $10,000 | $8,000 | $2,000 | -$2,500 |

| April | $15,000 | $9,000 | $6,000 | $3,500 |

| May | $20,000 | $10,000 | $10,000 | $13,500 |

| June | $18,000 | $9,500 | $8,500 | $22,000 |

| July | $15,000 | $9,000 | $6,000 | $28,000 |

| August | $12,000 | $8,500 | $3,500 | $31,500 |

| September | $10,000 | $8,000 | $2,000 | $33,500 |

| October | $8,000 | $7,500 | $500 | $34,000 |

| November | $7,000 | $7,000 | $0 | $34,000 |

| December | $6,000 | $7,500 | -$1,500 | $32,500 |

Key takeaway: Plan for the lean months. Consider diversifying crops or adding value-added products to smooth out cash flow.

Risk Management and Insurance

Let’s face it, farming is risky business. Here’s how different types of insurance can protect your ROI:

| Insurance Type | What It Covers | Annual Cost (% of Coverage) | ROI Protection |

| Crop Insurance | Crop loss due to weather, pests, etc. | 2-5% | High |

| Property Insurance | Damage to structures and equipment | 0.5-2% | Medium-High |

| Liability Insurance | Legal issues, injuries on property | 0.5-1.5% | Medium |

| Business Interruption | Lost income due to disasters | 1-3% | Medium-High |

| Workers’ Compensation | Employee injuries | Varies by state and payroll | Required |

Pro tip: Don’t skimp on insurance. One bad season or accident could wipe out years of profits if you’re not properly covered.

Financial Ratios for Greenhouse Performance

Finally, let’s talk about some key financial ratios that can help you gauge your greenhouse’s financial health:

| Ratio | Formula | Good Range | What It Tells You |

| Gross Profit Margin | (Revenue – COGS) / Revenue | >30% | Pricing and production efficiency |

| Operating Profit Margin | Operating Profit / Revenue | >15% | Overall operational efficiency |

| Debt-to-Equity | Total Liabilities / Shareholders’ Equity | <2:1 | Financial leverage and risk |

| Current Ratio | Current Assets / Current Liabilities | >1.5:1 | Short-term solvency |

| Inventory Turnover | COGS / Average Inventory | >6 | How quickly you’re selling product |

Remember: These ratios are guidelines. Your ideal numbers may vary based on your specific business model and growth stage.

6. Tracking and Improving Greenhouse ROI Over Time

Implementing Record-Keeping Systems

First things first: you can’t improve what you don’t measure. Here’s a breakdown of record-keeping systems to keep your greenhouse finances in check:

| System Type | Features | Best For | Cost Range | ROI Impact |

| Spreadsheets (e.g., Excel) | Basic, customizable | Small operations | Free – $150/year | +1-3% |

| Accounting Software (e.g., QuickBooks) | Financial reports, invoicing | Medium operations | $25 – $180/month | +3-5% |

| Farm Management Software | Crop planning, inventory, financials | Large operations | $50 – $250/month | +5-8% |

| Custom ERP Systems | Fully integrated operations management | Enterprise-level | $10,000+ upfront | +8-12% |

Pro tip: Choose a system that you’ll actually use. The fanciest software in the world won’t help if it’s too complicated for your needs!

Analyzing Seasonal Variations in ROI

Greenhouse profitability can be as cyclical as the seasons. Let’s break it down:

Quarterly ROI Comparison (Example)

| Quarter | Revenue | Expenses | Profit | ROI | Key Factors |

| Q1 (Jan-Mar) | $50,000 | $40,000 | $10,000 | 20% | High heating costs, early crop sales |

| Q2 (Apr-Jun) | $80,000 | $50,000 | $30,000 | 37.5% | Peak growing season, strong sales |

| Q3 (Jul-Sep) | $70,000 | $45,000 | $25,000 | 35.7% | Continued strong sales, lower energy costs |

| Q4 (Oct-Dec) | $40,000 | $35,000 | $5,000 | 12.5% | Slowing sales, increasing heating costs |

Key takeaway: Plan your cash flow and production schedule to maximize profitability during peak seasons and minimize losses during slower periods.

Strategies for Continuous Improvement and Cost Reduction

Now, let’s talk about squeezing more profit out of every square foot. Here are some strategies to boost your ROI:

| Strategy | Implementation Difficulty | Potential ROI Boost | Timeframe |

| Energy Audit and Upgrades | Medium | +5-10% | 6-12 months |

| Crop Diversification | Medium | +8-15% | 1-2 seasons |

| Automation Implementation | High | +10-20% | 1-3 years |

| Marketing and Direct Sales | Medium | +15-25% | 6-18 months |

| Staff Training and Efficiency | Low | +3-7% | 3-6 months |

| Waste Reduction Programs | Low | +2-5% | Immediate |

Remember: Small improvements add up. Don’t underestimate the power of incremental changes!

Using Data Analytics for Decision Making

Welcome to the 21st century, where data is the new fertilizer. Here’s how to use analytics to supercharge your ROI:

Key Performance Indicators (KPIs) for Greenhouse Operations

| KPI | What It Measures | Target Range | How to Improve |

| Yield per Square Foot | Production efficiency | Crop-specific | Optimize growing conditions, plant spacing |

| Energy Use per Pound of Produce | Energy efficiency | <1 kWh/lb | Upgrade HVAC, use energy curtains |

| Labor Hours per Unit of Production | Labor efficiency | Crop-specific | Implement automation, improve workflows |

| Water Use Efficiency | Water management | >90% | Install drip irrigation, recycle water |

| Profit per Crop | Crop profitability | >30% margin | Focus on high-value crops, reduce input costs |

Pro tip: Set up a dashboard to monitor these KPIs in real-time. Quick access to data means quicker decision-making!

Benchmarking Against Industry Standards

How do you stack up against the competition? Let’s look at some industry benchmarks:

| Metric | Industry Average | Top Performers | Your Goal |

| Overall ROI | 10-15% | >20% | Set your target |

| Energy Costs (% of Revenue) | 15-20% | <10% | |

| Labor Costs (% of Revenue) | 25-30% | <20% | |

| Crop Loss Rate | 5-10% | <3% | |

| Revenue per Square Foot | $30-$50 | >$75 |

Key point: Don’t just aim for average. Strive to be in the top performer category!

Adapting to Market Trends and Consumer Preferences

The market is always changing, and your greenhouse needs to change with it. Here’s how to stay ahead of the curve:

| Trend | Market Potential | Implementation Difficulty | ROI Impact |

| Organic Produce | High and growing | Medium | +10-20% |

| Exotic/Specialty Crops | Niche but profitable | Medium-High | +15-30% |

| Vertical Farming | Growing in urban areas | High | +20-40% |

| Sustainable Packaging | Increasing demand | Low-Medium | +5-10% |

| Direct-to-Consumer Sales | Expanding rapidly | Medium | +15-25% |

Remember: Stay flexible and be ready to pivot. The most successful greenhouse operations are those that can adapt quickly to changing market conditions.

Continuous Education and Innovation

Last but not least, never stop learning. The greenhouse industry is evolving faster than a tomato plant in the height of summer!

ROI of Continuing Education

| Educational Investment | Cost Range | Potential ROI Boost | Payback Period |

| Industry Conferences | $1,000 – $3,000 | +2-5% | 6-12 months |

| Online Courses | $100 – $1,000 | +1-3% | 3-6 months |

| Consultant Hire | $5,000 – $20,000 | +5-15% | 1-2 years |

| Research Partnerships | Varies | +10-30% | 2-5 years |

| Staff Training Programs | $500 – $2,000 per employee | +3-8% | 6-18 months |

Pro tip: Allocate a portion of your budget specifically for education and innovation. It’s an investment in your future profitability!

7. Case Studies: Successful Commercial Greenhouse ROI Examples

Small-Scale Urban Greenhouse Operation

Meet Sarah, a former software engineer who turned her passion for plants into a thriving urban greenhouse business in the heart of Chicago.

Key Stats:

- Greenhouse Size: 5,000 sq ft

- Initial Investment: $200,000

- Primary Crops: Microgreens, herbs, and edible flowers

- Target Market: High-end restaurants and farmers markets

| Year | Revenue | Expenses | Net Profit | ROI |

| 1 | $180,000 | $150,000 | $30,000 | 15% |

| 2 | $250,000 | $180,000 | $70,000 | 35% |

| 3 | $320,000 | $200,000 | $120,000 | 60% |

Success Factors:

- Niche Market Focus: Sarah identified a gap in the market for ultra-fresh, locally grown specialty produce.

- Vertical Growing Systems: Maximized space utilization in the small urban lot.

- Direct Sales Relationships: Built strong connections with chefs and market customers.

- Energy Efficiency: Invested in LED lighting and smart climate controls to reduce operating costs.

Key Takeaway: Sarah’s success shows that even small operations can achieve high ROI by focusing on high-value crops and direct sales channels.

Large-Scale Hydroponic Lettuce Production

Next up is GreenLeaf Farms, a 10-acre hydroponic greenhouse operation specializing in lettuce and leafy greens.

Key Stats:

- Greenhouse Size: 435,600 sq ft (10 acres)

- Initial Investment: $15 million

- Primary Crops: Various lettuce varieties, spinach, kale

- Target Market: Grocery chains and food service distributors

| Year | Revenue | Expenses | Net Profit | ROI |

| 1 | $4,000,000 | $3,500,000 | $500,000 | 3.3% |

| 2 | $7,000,000 | $5,000,000 | $2,000,000 | 13.3% |

| 3 | $10,000,000 | $6,500,000 | $3,500,000 | 23.3% |

| 4 | $12,000,000 | $7,000,000 | $5,000,000 | 33.3% |

Success Factors:

- Scale and Efficiency: Large-scale production allowed for economies of scale.

- Advanced Automation: Robotic harvesting and packaging systems reduced labor costs.

- Water Recycling: Closed-loop hydroponic system saved on water and fertilizer costs.

- Year-Round Production: Climate-controlled environment ensured consistent supply.

Key Takeaway: GreenLeaf’s case demonstrates that while large operations may have slower initial ROI, they can achieve significant profitability through efficiency and consistent production.

Specialty Crop Greenhouse with High-Value Products

Our final case study is Exotic Blooms, a 2-acre greenhouse specializing in orchids and other exotic flowers.

Key Stats:

- Greenhouse Size: 87,120 sq ft (2 acres)

- Initial Investment: $5 million

- Primary Crops: Various orchid species, tropical flowers

- Target Market: Florists, wedding planners, and direct-to-consumer online sales

| Year | Revenue | Expenses | Net Profit | ROI |

| 1 | $1,500,000 | $1,200,000 | $300,000 | 6% |

| 2 | $2,500,000 | $1,500,000 | $1,000,000 | 20% |

| 3 | $3,500,000 | $1,800,000 | $1,700,000 | 34% |

Success Factors:

- High-Value Crop Selection: Focus on premium, high-margin products.

- Specialized Growing Conditions: Invested in precise climate control for optimal orchid growth.

- Brand Development: Created a luxury brand image for their products.

- E-commerce Integration: Developed a strong online presence for direct sales.

Key Takeaway: Exotic Blooms shows that specializing in high-value crops can lead to impressive ROI, especially when combined with strong branding and diverse sales channels.

Comparative Analysis of Case Studies

Let’s break down what we can learn from these three very different operations:

| Aspect | Urban Microgreens | Hydroponic Lettuce | Exotic Flowers |

| Initial Investment | Low | High | Medium |

| Time to Profitability | Quick (Year 1) | Gradual (Year 2-3) | Moderate (Year 2) |

| Labor Intensity | Medium | Low (Automated) | High (Specialized) |

| Market Volatility | Low (Diverse Clients) | Medium (Bulk Contracts) | High (Luxury Market) |

| Energy Efficiency Focus | High | Very High | Medium |

| Sales Channel Diversity | High | Low | Medium |

Key Insights:

- Niche Matters: All three operations found success by identifying and serving specific market needs.

- Efficiency is Key: Whether through technology, smart design, or specialized knowledge, efficiency drove profitability.

- Scalability vs. Specialization: Both approaches can work, but they require different strategies and investment levels.

- Adaptability: Each operation showed flexibility in responding to market demands and operational challenges.

Lessons for Improving Your Greenhouse ROI

Based on these case studies, here are some actionable tips for boosting your own greenhouse ROI:

- Know Your Market: Research thoroughly and find a niche that matches your capabilities and passion.

- Invest in Efficiency: Whether it’s through technology, design, or processes, efficiency improvements have a compounding effect on ROI.

- Build Strong Relationships: Whether with chefs, distributors, or end consumers, solid relationships can provide stable income and valuable feedback.

- Brand Strategically: Even in agriculture, branding can set you apart and justify premium prices.

- Embrace Technology: From climate control to sales platforms, tech can be a game-changer for operations of any size.

- Plan for Scale: Start with a solid foundation that allows for growth as you prove your concept.

- Diversify Thoughtfully: Whether in crops or sales channels, diversification can provide stability and growth opportunities.

Remember: Every greenhouse operation is unique. The key is to learn from others’ successes, but tailor your approach to your specific circumstances, resources, and goals.

8. Common Pitfalls in Greenhouse ROI Calculations

Overlooking Hidden Costs

It’s easy to focus on the big-ticket items, but those sneaky little expenses can add up fast. Here’s a breakdown of commonly overlooked costs:

| Cost Category | Often Overlooked Expenses | Potential Impact on ROI |

| Utilities | Peak demand charges, water quality treatment | -2% to -5% |

| Maintenance | Replacement parts, specialized tools | -1% to -3% |

| Labor | Training, overtime, benefits | -3% to -7% |

| Compliance | Permits, certifications, inspections | -1% to -2% |

| Marketing | Packaging, branding, samples | -2% to -4% |

| Shrinkage | Crop loss, theft, spoilage | -3% to -8% |

Pro Tip: Create a comprehensive checklist of ALL expenses, no matter how small. It’s better to overestimate costs than to be blindsided later!

Unrealistic Revenue Projections

Oh, the temptation of optimism! But overestimating your income can lead to serious cash flow problems. Let’s look at some common projection mistakes:

Revenue Projection Pitfalls

- Assuming 100% Sellable Yield:

- Reality: Expect 80-90% sellable yield due to quality issues, damage, etc.

- Ignoring Seasonal Price Fluctuations:

- Example: Tomato prices can vary by 50% or more throughout the year.

- Overestimating Production Capacity:

- Realistic production ramp-up: Year 1 (60-70%), Year 2 (80-90%), Year 3 (95-100%)

- Neglecting Market Saturation:

- Consider: How much can your local market actually absorb?

Here’s a comparison of optimistic vs. realistic revenue projections for a small tomato greenhouse:

| Year | Optimistic Projection | Realistic Projection | Difference |

| 1 | $200,000 | $120,000 | -40% |

| 2 | $300,000 | $225,000 | -25% |

| 3 | $400,000 | $340,000 | -15% |

Key Takeaway: Always use conservative estimates in your ROI calculations. It’s better to be pleasantly surprised than disappointingly broke!

Failing to Account for Market Fluctuations

The market can be as unpredictable as the weather (and we all know how that goes). Here’s how to factor in market volatility:

- Research Historical Price Data: Look at 5-10 years of price trends for your crops.

- Consider Multiple Scenarios: Calculate ROI for best-case, worst-case, and most likely scenarios.

- Diversify Your Crop Mix: This can help stabilize income across market fluctuations.

Example: Impact of Market Fluctuations on Lettuce ROI

| Scenario | Price per Head | Annual Revenue | Expenses | ROI |

| Best Case | $2.50 | $500,000 | $350,000 | 42.9% |

| Most Likely | $2.00 | $400,000 | $350,000 | 14.3% |

| Worst Case | $1.50 | $300,000 | $350,000 | -14.3% |

Pro Tip: Build a financial buffer to weather market downturns. Aim for 3-6 months of operating expenses in reserve.

Underestimating Startup Time and Costs

Rome wasn’t built in a day, and neither is a profitable greenhouse operation. Here’s a realistic timeline:

| Phase | Duration | Often Overlooked Costs |

| Planning & Permits | 3-6 months | Consultant fees, application costs |

| Construction | 4-8 months | Site preparation, utility connections |

| System Setup | 1-2 months | Initial calibration, staff training |

| Crop Establishment | 2-4 months | First crop cycle might be suboptimal |

| Market Establishment | 6-12 months | Marketing, relationship building |

Remember: Your ROI calculation should factor in these startup phases where you’re spending money but not yet generating revenue!

Ignoring the Time Value of Money

A dollar today is worth more than a dollar tomorrow. That’s where Net Present Value (NPV) comes in. Here’s why it matters:

Comparison: Simple ROI vs. NPV

Let’s say you’re considering two greenhouse projects with an initial investment of $100,000 each:

| Project | Year 1 Profit | Year 2 Profit | Year 3 Profit | Simple ROI |

| A | $20,000 | $40,000 | $60,000 | 40% |

| B | $50,000 | $40,000 | $30,000 | 40% |

Looks the same, right? Now let’s calculate NPV with a 10% discount rate:

| Project | NPV | Better Choice |

| A | $88,816 | |

| B | $97,285 | ✓ |

Key Point: NPV considers the timing of cash flows, giving a more accurate picture of a project’s value over time.

Neglecting Opportunity Costs

Remember, every choice has a trade-off. When calculating ROI, consider what you’re giving up:

- Alternative Investments: Could your money earn more elsewhere?

- Personal Time: What’s the value of your time if spent on other pursuits?

- Land Use: Are there more profitable ways to use your land?

Example: Greenhouse vs. Alternative Land Use

| Option | 5-Year ROI | Other Factors to Consider |

| Greenhouse | 50% | Year-round income, higher complexity |

| Leasing to Solar Farm | 30% | Passive income, lower risk |

| Traditional Field Crops | 20% | Lower initial investment, weather dependent |

Pro Tip: Sometimes the highest ROI isn’t always the best choice if it doesn’t align with your skills, interests, or long-term goals.

Forgetting About Taxes

Last but certainly not least, don’t forget about Uncle Sam’s cut! Tax implications can significantly impact your real ROI.

| Tax Consideration | Impact on ROI | Strategy |

| Income Tax | Can reduce net profit by 15-35% | Maximize deductions, consider business structure |

| Property Tax | Ongoing expense, varies by location | Factor into annual costs, look for agricultural exemptions |

| Sales Tax | May apply to some inputs or sales | Check local laws, consider registration as ag producer |

Remember: Always consult with a tax professional familiar with agricultural businesses. The rules can be complex and vary by location.

9. Technology and Innovation in Greenhouse ROI Optimization

Smart Sensors and IoT for Precise Climate Control

The Internet of Things (IoT) has arrived in the greenhouse, and it’s changing the game for climate control. Let’s break it down:

| Technology | Function | Potential ROI Impact | Implementation Cost |

| Temperature Sensors | Monitor and adjust heat | +5-10% yield increase | $$ |

| Humidity Sensors | Control moisture levels | Reduce disease by 20-30% | $$ |

| CO2 Sensors | Optimize carbon dioxide levels | +15-25% growth rate | $$ |

| Light Sensors | Adjust artificial lighting | 20-30% energy savings | $$$ |

| Soil Moisture Sensors | Precision irrigation | 30-50% water savings | $$ |

Key Benefit: These smart systems can communicate with each other and your central control system, creating a harmonious growing environment that maximizes yield while minimizing resource use.

Case Study: SmartGrow Farms

SmartGrow implemented a fully integrated IoT system in their 5-acre tomato greenhouse:

- Initial Investment: $200,000

- Annual Savings: $150,000 (energy, water, labor)

- Yield Increase: 22%

- ROI: 75% in the first year, ongoing benefits in subsequent years

Pro Tip: Start with one or two key sensors and expand your system as you see results. Not every greenhouse needs the full sci-fi treatment right away!

AI-Powered Crop Management Systems

Artificial Intelligence isn’t just for tech giants anymore. Here’s how AI is boosting greenhouse ROI:

- Predictive Analytics: Forecast crop yields, market demands, and potential issues.

- Automated Decision Making: Adjust growing conditions in real-time without human intervention.

- Image Recognition: Identify pests and diseases early, often before the human eye can spot them.

- Resource Optimization: Calculate the perfect balance of inputs for maximum yield and minimum waste.

| AI Application | Benefit | Potential ROI Boost |

| Yield Prediction | Better planning and marketing | +10-15% |

| Disease Detection | Early intervention, reduced crop loss | +15-25% |

| Resource Allocation | Optimized use of water, nutrients, energy | +20-30% |

| Labor Management | Improved scheduling and task allocation | +5-10% |

Remember: AI systems learn and improve over time. The longer you use them, the more valuable they become!

Renewable Energy Integration for Cost Reduction

Going green isn’t just good for the planet – it’s great for your bottom line too. Here’s how renewable energy is changing the greenhouse game:

Comparison of Renewable Energy Options for Greenhouses

| Energy Source | Initial Cost | Energy Savings | Payback Period | Additional Benefits |

| Solar Panels | $$$ | 60-80% | 5-10 years | Low maintenance, long lifespan |

| Wind Turbines | $$$$ | 50-70% | 7-12 years | Works day and night |

| Geothermal | $$$$ | 40-70% | 8-15 years | Provides both heating and cooling |

| Biomass Boilers | $$$ | 30-50% | 4-8 years | Can use agricultural waste as fuel |

Case Study: SunGrow Greenhouses SunGrow installed a hybrid solar-geothermal system:

- Initial Investment: $500,000

- Annual Energy Savings: $100,000

- Additional Revenue from Grid Sellback: $20,000/year

- ROI: 24% annually after payback period

Key Takeaway: While the upfront costs can be significant, renewable energy can provide stable, predictable energy costs for decades, insulating your operation from volatile energy markets.

Advanced Growing Systems and Techniques

Innovation isn’t just about high-tech gadgets. New growing systems and techniques can significantly boost your ROI:

| System/Technique | Yield Increase | Resource Savings | Initial Cost |

| Vertical Farming | 200-300% per sq ft | 90% water savings | $$$ |

| Aeroponics | 300-400% | 95% water savings | $$$$ |

| Aquaponics | 200-300% | 90% water savings | $$$ |

| LED Grow Lights | 30-50% | 40-60% energy savings | $$$ |

| CO2 Enrichment | 20-30% | N/A (additional cost) | $$ |

Pro Tip: These advanced systems often work best for specific crops. Do your research to find the perfect match for your greenhouse!

Robotics and Automation in Greenhouse Operations

Welcome to the world of greenhouse robots! Here’s how automation is transforming labor-intensive tasks:

| Robotic System | Function | Labor Savings | Yield Impact |

| Harvesting Robots | Automated crop picking | 50-80% | +5-10% (less damage) |

| Planting Robots | Precision seeding and transplanting | 60-70% | +10-15% (better spacing) |

| Monitoring Drones | Aerial crop assessment | 40-50% | +5-10% (early issue detection) |

| Packaging Robots | Automated sorting and packing | 70-90% | N/A |

Case Study: AutoGrow Farms

AutoGrow implemented a fully automated harvesting system for their cucumber greenhouse:

- Initial Investment: $1,000,000

- Annual Labor Savings: $400,000

- Yield Increase: 8% (due to 24/7 operation and less crop damage)

- ROI: 40% annually after 2.5-year payback period

Key Benefit: Besides labor savings, automation can provide consistency, 24/7 operation, and detailed data collection for further optimization.

Data-Driven Decision Making and Analytics

In the modern greenhouse, data is as essential as water and sunlight. Here’s how to use it:

- Crop Performance Tracking: Analyze yield data to identify top-performing varieties and growing conditions.

- Predictive Maintenance: Use equipment data to schedule maintenance before breakdowns occur.

- Market Analysis: Combine your production data with market trends to optimize crop selection and timing.

- Resource Utilization: Track every input to identify inefficiencies and optimize usage.

| Data Application | Potential Benefit | ROI Impact |

| Yield Optimization | 15-25% yield increase | +10-20% |

| Predictive Maintenance | 30-50% reduction in downtime | +5-10% |

| Market-Driven Production | 20-30% increase in average selling price | +15-25% |

| Resource Optimization | 10-20% reduction in input costs | +5-15% |

Pro Tip: Start with the data you already have. Even simple spreadsheets can reveal valuable insights if you know what to look for!

10. Future Trends Affecting Commercial Greenhouse ROI

Changing Consumer Preferences and Market Dynamics

The only constant in the market is change, and boy, is it changing fast! Here’s what we’re seeing on the horizon:

| Trend | Description | Potential ROI Impact |

| Hyper-Local Produce | Consumers want food grown closer to home | +10-20% price premium |

| Organic & Pesticide-Free | Increasing demand for chemical-free produce | +30-50% price premium, but lower yields |

| Exotic & Heirloom Varieties | Growing interest in unique and heritage crops | +40-100% price premium for specialty items |

| Sustainable Packaging | Shift away from plastic towards eco-friendly options | -5-10% increased costs, but better market access |

| Functional Foods | Produce with added health benefits | +20-40% price premium for enhanced products |

Key Takeaway: The future favors niche, high-quality products over mass-produced commodities. Adapting to these trends could significantly boost your ROI.

Case Study: FutureFarms Inc.

FutureFarms pivoted to focus on rare heirloom tomatoes and pesticide-free leafy greens:

- Initial Investment in Transition: $500,000

- Revenue Before: $1,000,000

- Revenue After (Year 2): $1,800,000

- Net Profit Increase: 60%

- ROI on Transition: 140% in two years

Pro Tip: Stay connected with your customers. Their preferences are your roadmap to future profitability!

Climate Change Impacts on Greenhouse Operations

Climate change isn’t just a buzzword – it’s a reality that’s already affecting greenhouse operations. Here’s what to watch for:

| Climate Factor | Potential Impact | Adaptation Strategy | ROI Consideration |

| Extreme Temperatures | Higher cooling/heating costs | Enhanced insulation, thermal screens | +10-15% energy costs |

| Water Scarcity | Increased water prices, usage restrictions | Advanced water recycling systems | -20-30% water costs long-term |

| Severe Weather Events | Risk of structural damage | Reinforced greenhouse designs | +5-10% construction costs |

| Shifting Growing Zones | New crop opportunities/challenges | Flexible growing systems | Varies widely |

| Pest/Disease Patterns | New or more frequent outbreaks | Advanced IPM, resistant varieties | +5-10% crop protection costs |

Remember: Climate adaptation is an investment in your greenhouse’s long-term viability. It might hurt ROI in the short term but is crucial for future sustainability.

Emerging Technologies Shaping the Future of Agriculture

Hold onto your gardening hats, folks, because the future of greenhouse tech is mind-blowing! Here are some innovations to watch:

| Technology | Description | Potential ROI Impact | Adoption Timeline |

| CRISPR Gene Editing | Custom-designed crops for specific traits | +30-50% yield increases | 5-10 years |

| Nanotechnology Sensors | Molecular-level monitoring of plant health | +20-30% reduction in crop losses | 3-7 years |

| AI-Driven Climate Control | Self-adjusting, learning systems for perfect growing conditions | +15-25% energy efficiency | 1-3 years |

| Robotic Pollinators | Machines to supplement or replace bees | +10-20% yield in pollinator-dependent crops | 5-8 years |

| Vertical Ocean Farming | Greenhouses that utilize ocean resources | Opens new markets, +50-100% production in coastal areas | 10-15 years |

Key Point: While some of these technologies seem futuristic, early adopters often gain significant market advantages. Keep an eye on these trends and be ready to innovate!

Evolving Regulatory Landscape

Regulations can make or break your greenhouse ROI. Here’s what’s on the legislative horizon:

| Regulatory Area | Trend | Potential Impact on ROI |

| Carbon Emissions | Stricter limits, potential taxes | -5-15% due to compliance costs |

| Water Usage | Increased restrictions, higher prices | -10-20% without efficiency measures |

| Labor Laws | Higher minimum wages, stricter worker protections | -5-10% increased labor costs |

| Food Safety | More stringent traceability requirements | -2-5% for compliance, but better market access |

| Genetic Modification | Changing regulations on gene-edited crops | Could swing widely positive or negative |

Pro Tip: Get involved in industry associations. They often have the inside scoop on upcoming regulations and can help you prepare in advance.

Integration of Urban Agriculture

The line between rural and urban farming is blurring, and it’s creating exciting opportunities for greenhouse operators:

| Urban Ag Trend | Description | ROI Potential | Challenges |

| Rooftop Greenhouses | Growing on urban buildings | +30-50% premium for ultra-local produce | Higher setup costs, weight restrictions |

| Vertical Farming | Multi-story indoor growing | 10x yield per square foot | High energy costs, limited crop variety |

| Community-Integrated Greenhouses | Greenhouses as part of urban planning | Stable long-term contracts, educational revenue | Complex partnerships, zoning issues |

| Modular Micro-Greenhouses | Small, movable growing units | Quick setup, flexible locations | Limited scale, higher per-unit costs |

Case Study: UrbanGrow Solutions

UrbanGrow set up a network of rooftop greenhouses in New York City:

- Initial Investment: $5 million for 10 locations

- Annual Revenue: $3 million

- Operating Costs: $2 million

- ROI: 20% annually, with significant growth potential

Key Takeaway: Urban integration can offer premium prices and marketing advantages, but comes with unique logistical challenges.

Shift Towards Circular Economy Models

The future is circular, and greenhouses are no exception. Here’s how the circular economy could reshape greenhouse ROI:

| Circular Strategy | Description | ROI Impact | Implementation Difficulty |

| Waste-to-Energy | Converting organic waste to power | -20-30% energy costs | High |

| Water Reclamation | Advanced filtration for near-total water recycling | -40-60% water costs | Medium |

| CO2 Capture | Using industrial CO2 for greenhouse enrichment | +10-20% yield, potential carbon credits | Medium |

| Biodegradable Growing Media | Composting used media for soil enhancement | -5-10% waste management costs | Low |

| Integrated Aquaponics | Fish waste nutrients plants, plants clean fish water | +40-60% total output per square foot | High |

Remember: Circular strategies often have high upfront costs but can dramatically improve long-term ROI and sustainability.

Conclusion: Mastering ROI in Commercial Greenhouse Operations

As we wrap up our deep dive into the world of greenhouse ROI, let’s take a moment to reflect on the key insights we’ve uncovered and chart a course for your greenhouse success. Remember, calculating and optimizing ROI isn’t just about numbers – it’s about growing a thriving, sustainable business.

Let’s recap the most critical points we’ve covered:

- ROI is a dynamic metric: It’s influenced by countless factors, from crop selection to energy efficiency.

- Technology is a game-changer: Smart investments in tech can dramatically boost efficiency and yields.

- Market awareness is crucial: Consumer preferences and market trends should guide your decisions.

- Sustainability pays off: Environmental considerations often align with improved long-term profitability.

- Adaptability is key: The most successful operations are those that can pivot in response to new challenges and opportunities.

ROI Optimization Checklist

Here’s a handy checklist to keep you on track:

| Area | Action Items | Potential ROI Impact |

| Crop Selection | Research market trends, consider high-value crops | +10-30% |

| Energy Efficiency | Implement smart controls, explore renewable options | +15-25% |

| Labor Management | Invest in automation, optimize workflows | +10-20% |

| Water Management | Install precision irrigation, consider water recycling | +5-15% |

| Marketing | Develop direct-to-consumer channels, build brand | +20-40% |

| Technology | Adopt IoT sensors, explore AI-driven systems | +25-50% |

| Education | Stay informed about industry trends and innovations | Varies |

Pro Tip: Tackle these items one at a time. Consistent, incremental improvements can lead to significant ROI boosts over time.

Future-Proofing Your Greenhouse Operation

As we’ve seen, the future of greenhouse farming is both exciting and challenging. Here are some strategies to ensure your operation thrives in the years to come:

- Diversify Your Crop Mix: Don’t put all your eggs (or tomatoes) in one basket.

- Invest in Flexible Infrastructure: Choose systems that can adapt to different crops and growing methods.

- Build Strong Community Connections: Local support can be a lifeline during market fluctuations.

- Prioritize Sustainability: It’s not just good for the planet – it’s increasingly good for business too.

- Embrace Lifelong Learning: The industry is evolving rapidly. Your knowledge should too.

Final Thoughts: The ROI Mindset

As we conclude, I want to emphasize that mastering greenhouse ROI is more than just crunching numbers – it’s about adopting a mindset of continuous improvement and strategic thinking. Here’s a comparison of traditional vs. ROI-optimized greenhouse management:

| Aspect | Traditional Approach | ROI-Optimized Approach |

| Planning | Season-to-season | Long-term strategic planning |

| Technology | Viewed as expense | Seen as investment |

| Market Approach | Reactive | Proactive, trend-anticipating |

| Crop Selection | Based on familiarity | Data-driven, market-responsive |

| Resource Management | Focus on input costs | Holistic efficiency optimization |

| Innovation | Cautious adoption | Continuous experimentation |

| Success Metric | Yield | Profitability and sustainability |

Remember: The most successful greenhouse operators are those who view every decision through the lens of ROI – not just in terms of immediate financial returns, but in building a resilient, adaptable, and thriving business.

In conclusion, mastering ROI in commercial greenhouse operations is an ongoing journey. It requires diligence, innovation, and a willingness to adapt. But with the right approach, the rewards can be tremendous – not just in terms of profitability, but in the satisfaction of building a sustainable business that contributes to feeding the world.

FAQs: Calculating ROI for Commercial Greenhouses

What’s a good ROI for a commercial greenhouse?

A good ROI varies, but generally:

- 10-15%: Average

- 15-20%: Good

- 20%: Excellent

How long does it take to see a positive ROI in greenhouse farming?

Typically 2-5 years, depending on crop type, scale, and market conditions.

What costs are often overlooked in ROI calculations?

Common oversights include:

- Depreciation

- Marketing expenses

- Compliance costs

- Ongoing training

How can I improve my greenhouse’s ROI quickly?

Focus on:

- Energy efficiency upgrades

- Optimizing crop selection

- Improving labor efficiency

- Enhancing marketing strategies

How does greenhouse size affect ROI?

Generally, larger operations benefit from economies of scale, but require higher initial investment. Optimal size depends on market, crop, and management capacity.

What role does location play in greenhouse ROI?

Location affects:

- Energy costs

- Labor availability

- Market access

- Climate challenges Choose a location that balances these factors for optimal ROI.

How often should I recalculate my greenhouse’s ROI?

At minimum, annually. Ideally, track key metrics monthly and do a full ROI analysis quarterly.

Remember, ROI is a tool for decision-making, not just a number to chase. Use it wisely to guide your greenhouse operation towards sustainable profitability.

What crops offer the highest ROI in greenhouse farming?

Crops with high ROI potential include:

- Tomatoes

- Leafy greens

- Herbs

- Peppers

- Specialty or exotic produce

The best choice depends on your market and growing conditions.

How can I reduce energy costs in my greenhouse?

To reduce energy costs:

- Install energy-efficient lighting (e.g., LEDs)

- Use thermal screens

- Implement smart climate control systems

- Consider renewable energy sources like solar or geothermal

Is hydroponic growing more profitable than soil-based greenhouse farming?

Hydroponic systems often have higher initial costs but can lead to increased yields and efficiency. Profitability depends on crop choice and market demand.

How does automation affect greenhouse ROI?

Automation can significantly improve ROI by reducing labor costs, increasing efficiency, and improving crop consistency. However, it requires substantial upfront investment.

What’s the impact of organic certification on greenhouse ROI?

Organic certification can lead to premium pricing but may result in lower yields. The net effect on ROI varies, but it can be positive if there’s strong market demand.

How important is location for greenhouse ROI?

Location is crucial. It affects:

- Energy costs (climate)

- Market access

- Labor availability

- Regulatory environment

Choose your location strategically for optimal ROI.

Can small-scale greenhouse operations be profitable?

Yes, small-scale operations can be profitable, especially when focusing on high-value crops, direct-to-consumer sales, or niche markets.

How do I calculate the ROI for a new greenhouse technology?

To calculate ROI for new tech:

- Determine the total cost of the technology

- Estimate the annual benefits (increased revenue or decreased costs)

- Use the formula: ROI = (Annual Benefit / Total Cost) x 100

Consider both short-term and long-term impacts.